Introduction

Well before the pandemic hit, there was a major drive by the digital brokerage and execution platforms to attract Independent Wealth Managers (IWMs) by offering their services at lower cost than the banks and private banks. There is no doubt that the pandemic has further shifted the dial to digital solutions throughout the universe of wealth management across the globe. At the same time, amidst a crisis, the relative merits of tried and trusted banks and their apparent solidity have risen.

This, in turn, means that their customers need to think long and hard as to whether they want to migrate to new providers, especially if outside the banking net. Moreover, the incumbent custodian banks have recognised the need to challenge the electronic platforms and brokerages, against the new entrants current and future, in order to make their offerings and services more digitised, more streamlined, more comprehensive and more customer centric.

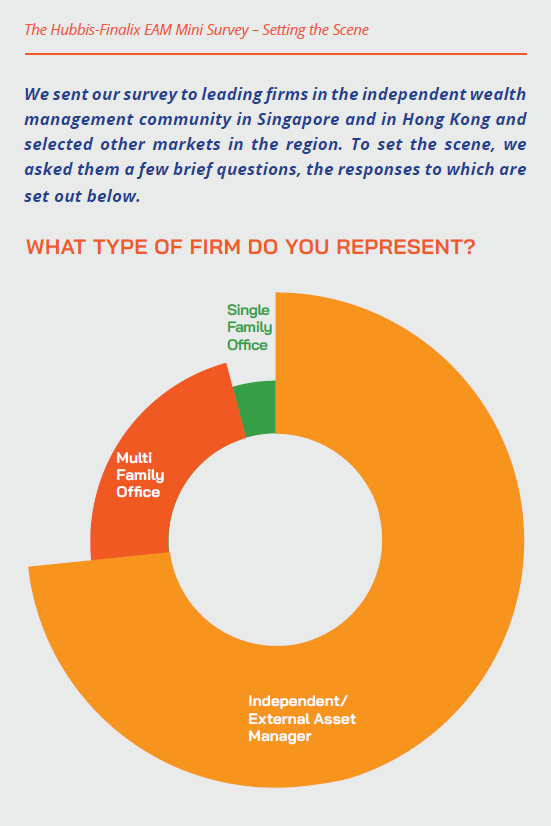

Hubbis, in conjunction with Swiss business consulting group Finalix, conducted a short survey of selected IWMs (IAMs, EAMs and family offices) in Asia to learn more as to why they and their private clients remain loyal to their incumbent custodian banks. The survey reveals how banks can serve their existing independent wealth managers better and gain additional market shares.

If there is a conclusion to be drawn, it is that the market for the IWMs in Asia is big enough and growing sufficiently robustly to allow for the leading digital platforms to compete head on without any major detriments to the traditional private banks yet. The growth will continue as a result from an increased potential customer base. However, in order to remain attractive for the Independent Wealth Management community, private banks need to offer a good mix between digital/online capabilities and easy access to tailored products & services.

What is the current situation?

The world of custody and execution has been evolving apace in recent years. While there was a time, not that long ago, when the only real viable options for independent wealth management firms and family offices in Asia were the Tier 1 private banks, today the digital online platforms and brokerages have been able to surge in both prominence and efficiency, emulating their performance in the major financial markets, especially in the US and Europe.

The world of custody and execution has been evolving apace in recent years. While there was a time, not that long ago, when the only real viable options for independent wealth management firms and family offices in Asia were the Tier 1 private banks, today the digital online platforms and brokerages have been able to surge in both prominence and efficiency, emulating their performance in the major financial markets, especially in the US and Europe.

What challenges are the traditional banks facing?

The platforms rise in Asia

In recent years, the digitally turbocharged platforms have been shift- The Hubbis-Finalix EAM Mini Survey – Setting the Scene We sent our survey to leading firms in the independent wealth management community in Singapore and in Hong Kong and selected other markets in the region. To set the scene, we asked them a few brief questions, the responses to which are set out below. Independent/ External Asset Manager ing their attention to the dynamic wealth markets of Asia Pacific, wanting to capture a sizeable slice of what had in the pre-Covid-19 world been the most robust region on the planet in terms of economic momentum and private wealth creation; hence the stage has been set for a dramatically more competitive environment.

The platforms have marketed themselves by offering what they consider more digitised, seamless, transparent, cost-effective solutions that today’s IWMs increasingly require and expect. They are not providing just efficient access, execution, and custody. Moreover, their vision is to offer all this with simplified onboarding, real-time analytics, bespoke reporting and portfolio valuations, upgraded user experiences, greater transparency, a broad universe of products, and discrete, high-quality regulatory compliance.

Challenged by entrepreneurial relationship managers

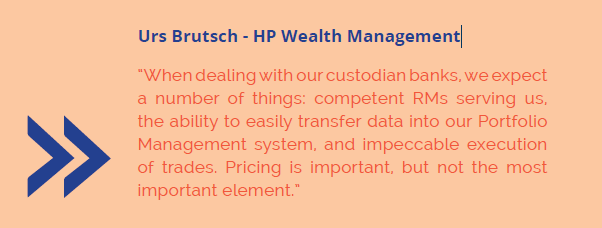

More top-flight bankers have been leaving the relative security of the Multi Family Office Single Family Office A HUBBIS MINI-SURVEY 4 HOW MANY CUSTODIAN BANKS OR FUND ADMINISTRATORS DO YOU WORK WITH? brand-name private banks to venture out on their own or to join established independents, lured by the prospect of greater personal working freedom, a greater ability to manage their clients’ assets in a totally objective manner with open architecture, and unencumbered by expectations or pressures of the banks.

The private banks are fighting back

However, whatever these digital disruptors maintain – and several do envision outstanding offerings – there is little doubt that the traditional incumbent Tier 1 banks and private banks will fight back even more vigorously, refining their management vision and strategy, building their digital capabilities, honing their internal structures, upgrading their internal efficiency, as well as re-focusing and sharpening their execution and custody capabilities and propositions for Independent Wealth Managers.

The independent digital platforms love the IWMs

The platforms know their target market, and a very important element is the independent wealth community, who at one stop aggregate the end clients in one location, and who have a need for better and usually lower-cost execution and custody solutions. And that is why the platforms spend a lot of time and effort in constant dialogue with these partners, the users of their platforms, to ensure that core functionality, including the required markets and assets, reporting protocols, different types of trading orders and so forth are relevant and in sync with market needs.

Are the new platforms real competition? Or is there still time to react?

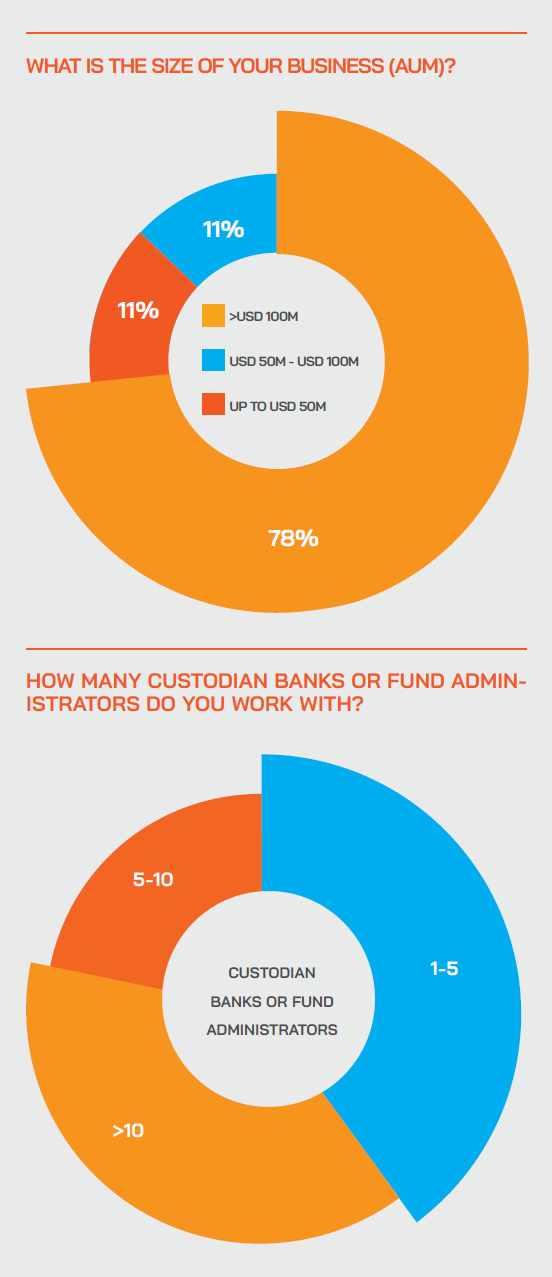

The digital trading platforms, as they are largely execution-only in philosophy and operations, can market themselves aggressively and cheaper. They support the independent wealth manager community by allowing them to offer hands-on advice and simply use these external platforms for execution and custody. As we found out in the survey, the independent wealth managers are not overly price-sensitive with only 8% of them stating profitability as one of their main objectives for the next 5 years. Custodian banks can still capitalize on their elevated service proposition, which our survey has shown to be one of their most value-added selling points for Independent Wealth Managers. Our respondents were many to highlight the importance of having a direct personal access to a dedicated desk (to an RM, Investment Manager or Trader) as well as an efficient operational support, when choosing to remain loyal or not to their custodian.

What should traditional banks do?

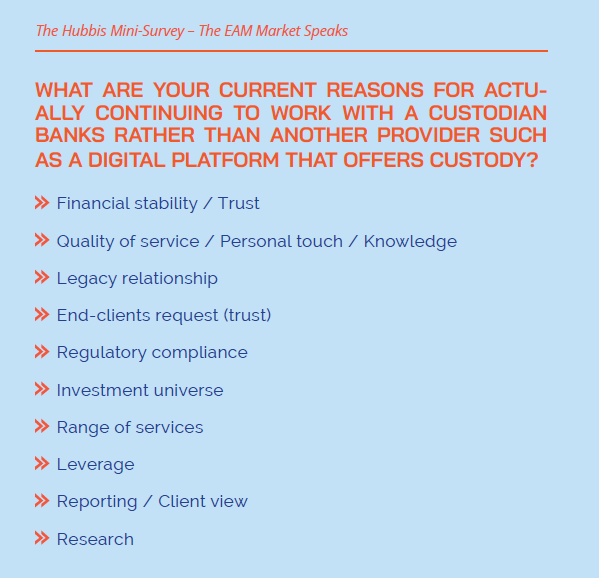

Do not rest on traditional laurels, but rather leverage the traditional strengths and combine them with digital capabilities. Indeed, our survey shows, the second most important factor to retain IWMs is the quality of service and personal touch of the incumbents, right after their financial stability and trust. Hence a smart evolution into a digitised servicing is the way to go.

Digitising the “right” capabilities by understanding the market needs

In fact, the Independent Wealth Managers told us that trading capability and standardized data feed were top of the list. That means the private banks have good reason for optimism in their drive to fight back – they are upgrading their technologies, processes and approach to execution/trading combined with standardized data feeds. Trading interface and Standardized data feed were in the top three requested offerings from a custodian.

Onboarding – get it right

We know how crucial digital onboarding is across all wealth and client categories, from the retail customer to the more institutionalsize players. Although the private banking community has been investing in FinTech & RegTech or digital onboarding solutions, for IWMs onboarding should run faster. A smooth and efficient onboarding is currently one of the main features expected by the Independent Wealth Managers while being at the same time one of the pain point experienced with custodian banks.

Focus on core strengths – safety, stability, and personal touch

The private banks and banks do have an advantage in pure custody itself, that is for sure. All the IWMs and their clients know the importance of size, capital, history, governance, and financial stability. The incumbent custodian banks also have a ready-made advantage. The reality is that the choice of custodians is not the IWMs alone – very often the private clients who are willing to move their advisory and AUM relationships to the IWMs will at the same time want to retain the feeling of security and continuity of keeping their execution and custody with the private banks with which they very probably already had accounts and relationships. Our survey has shown that the legacy relationship and end client trust in Private banks are amongst the top reasons why some IWMs are reluctant to take the leap and go with digital platform for custody. Some of the biggest IWMs that work with multiple custodian banks can leverage their power to negotiate preferential terms and pass some of those savings back to their HNW clients. On the other hand, there is evidence since last year from Switzerland that some of the banks there have actually been increasing their charges to the IWMs, in order to fight back and regain the direct business with the end private clients, trying to shake them into a fear that they cannot get such a good price for execution and custody unless they return fully to the private bank fold.

Combine personal interaction and digital self-service

The traditional operating model of the private banks to serve IWMs personally via dedicated desks and A HUBBIS MINI-SURVEY 7 traditional channels like e-mail and phone is outdated. A shift towards a hybrid model combining personal interaction and digital functionalities is fundamental going forward. Basic functionalities, such as clients having their client book and portfolio details available digitally, online trading – including straight-through-processing (STP) – are now expected by the IWMs.

Research & real time market data

Market Research is another field where the incumbent banks have an edge over the competition as this isn’t part of the focused service offering of platforms. IWMs are fond of such content and insights to engage and educate their clients. Nonetheless, it is a partial success for banks as on one side their highquality market research is praised by the IWMs, but on the other side they fail to completely meet their demand. We can question if this gap represents the access or delivery of such content or the fact that many banks still lag behind when it comes to offering real time market data.

Swings and roundabouts…

There is an old adage in the English language that what you gain on the swings, you lose on the roundabouts. When looking at the private bank models and the IWM community, that adage seems to apply quite well. It is actually a somewhat odd situation really, as the independents themselves are trying to prise private clients away from the private banks at the same time as the private banks are increasingly determined to provide a better execution and custody offering to those same IWMs who might be winning over their private clients.

The traditional banks are of course pragmatists – they recognise that what they might lose in terms of direct sway over the private client himself or herself, they can, to some extent, regain through the ongoing execution and custody relationship via the IWM with those end clients. And if the IWM community continues on its trajectory in Asia, the private banks dare not ignore their growing power and presence. There is indeed an increasing alignment between the typical Swiss models of IWM and the emerging Asian model. As the business has grown, the competition has increased, and the quality of the offerings have improved. Talent at the IWMs has also improved, and the talent pool is younger, and they demand more digital tools to better serve their clients. There is no doubt that amongst the key attributes that make the IWM so valuable for HNW and UHNW private clients the sense of independence and alignment with the client is paramount, while enhanced client centricity and elevated quality of advice are also important elements. A more nuanced view is that many private clients still these days prefer to work with the private banks for execution and custody, for the feeling of security in preference to the lowest possible fees. Many feel ok with paying that premium so they can sleep easier at night.

The final word

The opportunities for the incumbent banks in serving the IWM community are significant, WHAT ARE YOUR CURRENT REASONS FOR ACTUALLY CONTINUING TO WORK WITH A CUSTODIAN BANKS RATHER THAN ANOTHER PROVIDER SUCH AS A DIGITAL PLATFORM THAT OFFERS CUSTODY? Financial stability / Trust Quality of service / Personal touch / Knowledge Legacy relationship End-clients request (trust) Regulatory compliance Investment universe Range of services Leverage Reporting / Client view Research The Hubbis Mini-Survey – The EAM Market Speaks and there are a number of them, especially the boutique international Swiss private banks, that have greatly boosted their IWM proposition with a dedicated IWM desk and RM allocated to IWM clients. The IWM model itself is all about incremental improvements and being independent without the legacy infrastructural hindrances the incumbent banks may suffer from. But that does not mean that the IWM community will shy away from working with those private banks that offer the right levels of service, technology, the right attitudes, and high levels of customer-centricity. Both parties will benefit from an elevated offering from the private banks. In short, they have much to gain and much to lose by not boosting their propositions and connectivity.

About finalix

Finalix is a consulting boutique with a focus on the financial industry. Originating from Switzerland, the company was founded in 2001 and opened an office in Singapore in 2019.

Finalix supports a wide range of financial services providers from banking – universal banks, private banks, asset managers, and private equity corporations – to insurance. The company focuses on digitisation and transformation projects covering key senior roles on the business side as product owners, SMEs and stream leads. Finalix consultants have on average more than 12 years of significant work experience with renowned consulting companies and senior roles in the financial services industry. They bring strong skill sets, fast adaptability to new environments, and instant value delivery to their projects.

About gateB

gateB is a MarTech consulting and implementation company that empowers national and international companies to unlock their digital potential and enable smarter customer relations.

With the intelligent use of data and technologies, gateB transforms relevant business processes and generates quantifiable added value for leading brands. gateB was founded in 2009 and employs more than 85 consultants, implementation specialists, and data scientists in Switzerland, Los Angeles, and Singapore.