A study of the opportunities and challenges for custodian banks in the current market environment

Method and trends

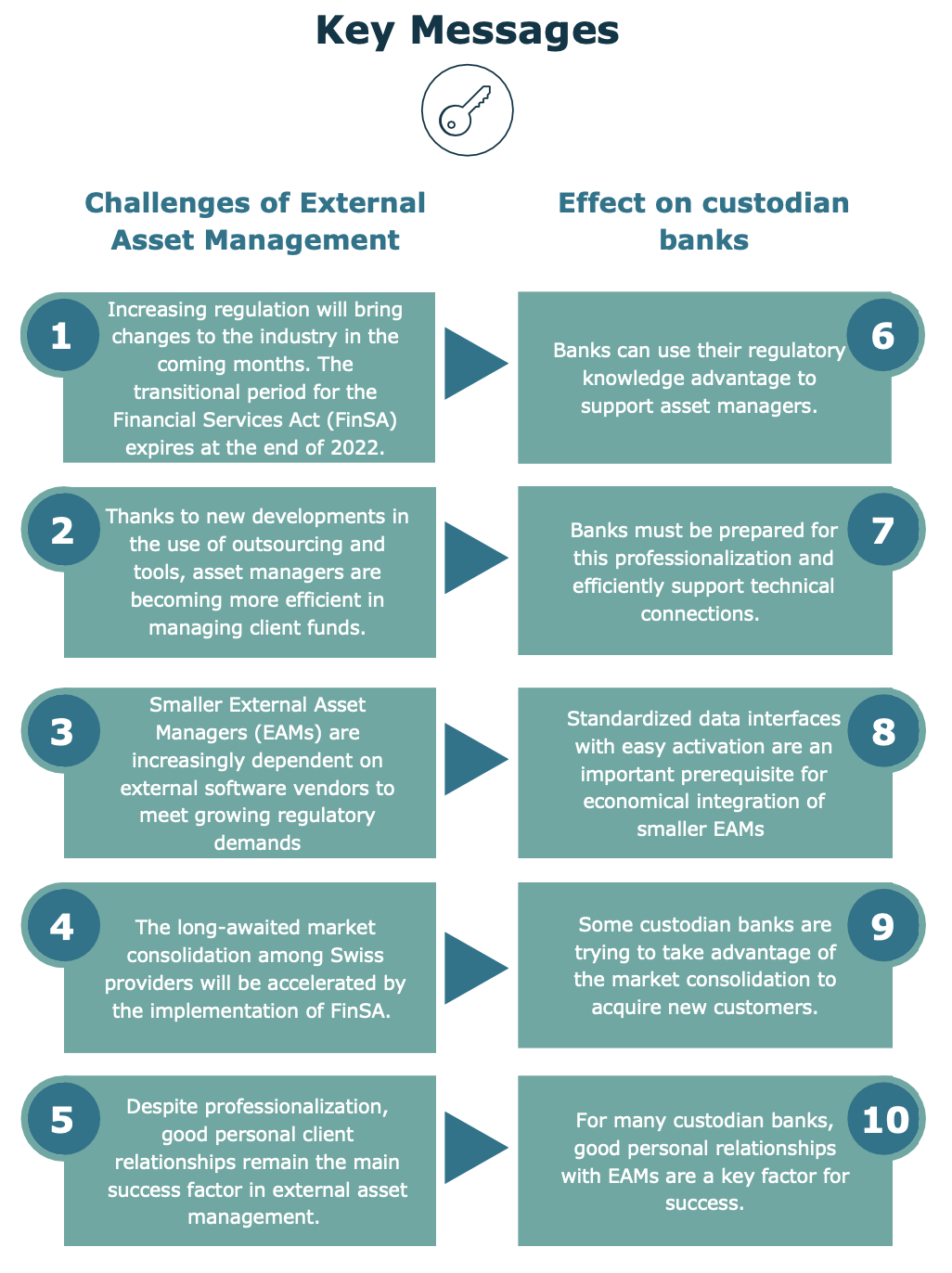

A clear picture of the most important developments in the EAM market was drawn from personal interviews with managers from seven of the largest custodian banks in Switzerland, coupled with personal experience. Driven by various trends, EAMs are increasingly professionalizing the investment, settlement and control processes. The Swiss regulator, Financial Market Supervisory Authority (FINMA) sets the pace with Financial Services Act (FinSA) and Financial Institutions Act (FinIA) regulations.

Two different perspectives

In personal interviews, we examined the seven most discussed trends in the Swiss EAM market. The interviewees were proven experts with many years of experience holding leading positions at custodian banks in external asset management.

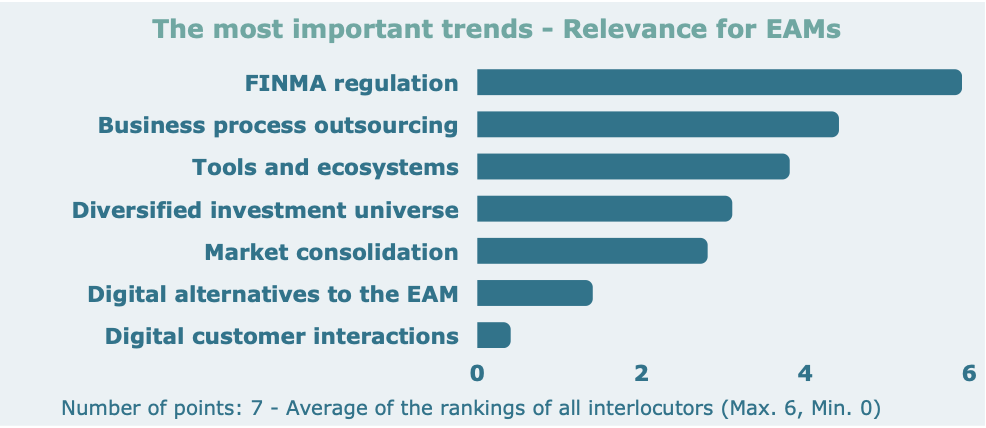

The seven selected trends were analyzed from two different perspectives. The “Relevance for EAMs” perspective shows the most important developments for the asset managers themselves, and why. The “Relevance for custodian banks” perspective, on the other hand, shows which of the trends are important for custodian banks.

For both perspectives, a priority order was developed with the interviewees. The aim of this dual perspective is to enable a better understanding of the relationships between EAMs and custodian banks. The two perspectives form the further structure of this article. However, let us first look at the issues discussed.

FINMA Regulation

As in almost all areas of the financial industry, FINMA regulations are now a top trend for EAMs. Since 2020, EAMs have been subject to the FinSA and FinIA.

What does this mean for the individual EAM and when do they have to react? What effects are expected on the overall market for EAMs and custodian banks?

Business process outsourcing

How much does business process outsourcing by EAMs impact the market? It is increasingly being observed, particularly in the context of control and risk management processes. But is this trend also relevant for the banks?

Tools and ecosystems

External tools (e.g. portfolio management systems) are improving and can be more easily connected to the custodian banks. Does this development increase the willingness of EAMs to use them? What does this mean for custodian banks?

Diversified investment universe

In addition to the major trend towards sustainable investing, there is a global move towards more alternative investment opportunities. How does this affect Swiss EAMs? Are custodian banks ready for this development?

Market consolidation

Consolidation of the EAM market has long been predicted as a trend, but has never really manifested – until now. Market consolidation means a reduction in the number of active EAMs due to mergers or business closures. Will there be a big market consolidation? What is the opinion of the banks?

Digital alternatives to EAM

Time and time again, we read and hear that robo-advisory and investment apps could significantly attract assets. Do offerings like TrueWealth, Vontobel Volt and the like really represent noticeable competition for the EAMs? Or is that still a long way off in the future?

Digital customer interactions

Also – but not only due to the pandemic, many interactions no longer take place physically, but via voice or video call. How has this global trend arrived in the EAM industry? We want to know whether this trend – in the opinion of the custodian banks – will fundamentally change the industry.

Structural change in the EAM market

This section highlights current industry trends with a focus on EAMs. The EAM market is in a phase of structural change. Increased regulatory requirements, new technological opportunities and higher demand for more sustainable, specific investment solutions will result in more technologically advanced, professional EAMs in the future.

Increasing regulation casts a long shadow over the wealth management industry

For a long time, EAMs were not as affected by increasing regulation as banks, insurers or fund managers. In Switzerland, this has changed since the introduction of the FinSA and the FinIA in 2020. In particular, the adaptation to FinSA is now a major concern for many EAMs.

Under FinSA, all asset managers (including EAMs) will require a FINMA license to conduct business as of January 1, 2020. By the end of 2022, the transitional period for asset managers existing before FinSA comes into force will expire. This means that a license application must be submitted to FINMA by December 31, 2022 at the latest. According to FINMA, approximately 2,400 asset managers were operating on a professional basis as of January 1, 2020. However, by July 2022, FINMA had only issued around 250 licenses to asset managers and trustees1.

The very low number of approvals compared to the number of companies indicates that most EAMs are delaying the approval process. However, according to bank representatives, the proportion of firms already approved is significantly higher among medium-sized and large EAMs than in the market as a whole.

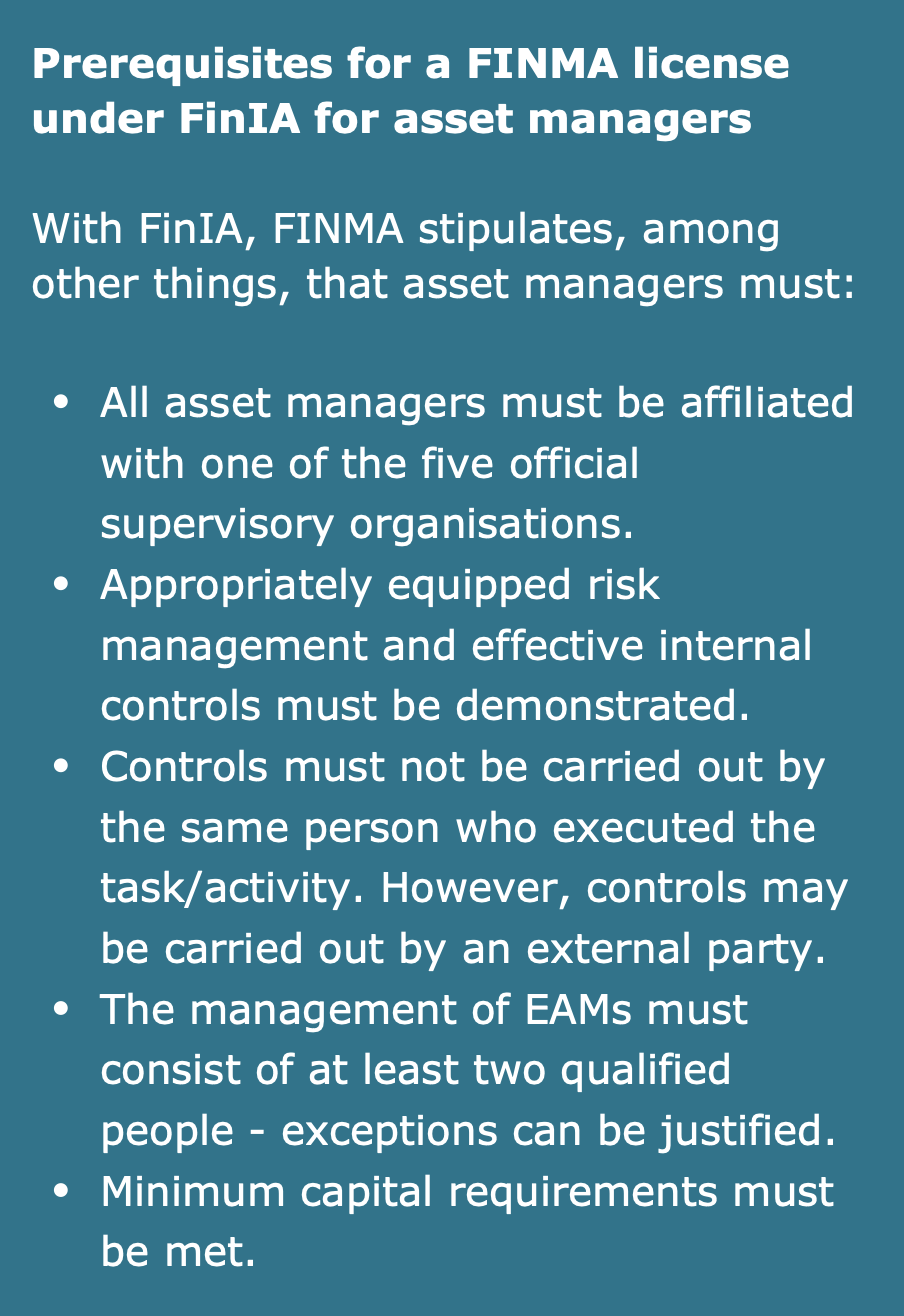

To obtain FINMA approval, EAMs must be affiliated with a supervisory organization (SO). The SO checks whether all requirements are met.

As of the beginning of April, five organizations had been approved as SOs1. Bottlenecks in the examination of applications for approval are inevitable given the number of applications still to be expected. The EAMs were therefore already urged by officials in the fall of 2021 not to wait much longer with the process of approval.

Increasing regulation has been chosen as the number one trend by six of the seven banks surveyed, putting it well in first place on average (see chart below). There are three reasons for this: First, in the short term, many of the EAMs are very busy with tasks to ensure requirements are met and therefore have less time for further strategic development. Secondly, a consolidation of the market with acquisitions or joint ventures is expected. Thirdly, in the medium to long term, there will be visibly increased administrative efforts for the EAMs to meet the requirements.

The first two reasons are temporary, while the additional effort will remain until further notice. In particular, small and micro providers in asset management struggle to meet all FINMA requirements (see infobox on page 4) without assistance. Setting up and documenting control mechanisms is time- consuming. Staff shortages for controls are to be expected, especially for EAMs that have 1-3 employees and cannot count on support from a large organization.

There are diverse FinSA coping strategies for EAMs.

Many larger market players have already implemented and documented corresponding risk management and control processes. For them, the approval process is merely a formality or has already been completed. But for the majority of the remaining firms, this is not yet the case. In order to comply with FINMA requirements, they turn to different strategies. Six of which are listed below. In the interviews, none of the interviewees see a clear trend towards any of these strategies.

Stand-alone

FinSA requirements are covered single- handedly. Specific tools, such as WeCanComply, are increasingly being used for support. Medium-sized and large EAMs in particular will know how to help themselves in this way.

Outsourcing of internal controls

Outsourcing the required control and risk management processes is a valid option for EAMs of all sizes. FINMA explicitly allows “internal controls” to be performed by external parties.

Mergers with other EAMs

Many industry experts predict an increase in mergers between EAMs of similar size. By increasing the number of staff, a new, larger company could implement the requirements more efficiently and exploit economies of scale.

Affiliation with a bank

Some EAMs choose to affiliate with an already regulated organization. Examples in the market are affiliations of EAMs to private banks or via the Aquila partner model. For EAMs, however, this means giving up independence.

Abandonment of discretionary management

Abandoning discretionary management and thus focusing on advisory services was seen by some interviewees as a realistic way to address FinSA requirements. Advisory services without discretionary disposition rights of the EAM over investment decisions are not subject to FinSA regulation. The interviewees are not aware of any case so far where this route has been chosen.

Exit & Sell

The last option, which is particularly relevant for partners at an advanced age, is to sell or give up the business.

Increasing efficiency through outsourcing and digitization

Administrative efforts to meet the regulatory requirements of FinSA and FinIA will also increase in the medium and long term. Consequently, the costs for EAMs will also increase, while this additional effort will not result in additional revenues. This intensifies the already high pressure on margins in the asset management market.

EAMs deal with this pressure on margins in a very individual manner, but in general, a professionalization of processes and an increased use of tools can clearly be observed. This is also confirmed by the respondents, who put the outsourcing of business processes and access to digital ecosystems in second and third place.

When it comes to business process outsourcing, the areas of risk management and internal controls in particular were mentioned by many respondents. Specialized providers support EAMs in the transformation or carry out control processes (e.g. in anti-money laundering) on behalf of the EAMs. Such services are available in a comparatively cost-efficient manner because many of the tasks are standardized and the outsourcing providers are able to perform them through economies of scale. Outsourcing allows EAMs to continue to focus on their strengths in asset management and client retention.

The number three trend, the use of digital tools and ecosystems, is very closely related to outsourcing. With the technological development, there are more and more software providers, who provide highly effective portfolio (PMS) and customer data (CRM) management systems. Connecting these systems to custodian banks is becoming easier through automated interfaces called APIs (see info box below).

While outsourcing is often interesting even for very small EAMs, using ecosystems requires a certain technological and process maturity, or at least the will to achieve it and make the necessary investments.

Many EAMs still use very simple, often self- built, portfolio management solutions that allow simple calculations based on Excel, for example.

However, the regular review of agreed investment guidelines and risk monitoring, in such set ups, can only be ensured to a limited extent. The replacement of such self-made tools by professional PMS from external providers is on the agenda of many EAMs. External solutions are also increasingly being used for handling customer interaction, risk management and internal controls.

While mainly large EAMs use such systems so far, more and more smaller competitors will choose this path in the future. This is because the systems are easier to use and integrate.

However, the conversion from spreadsheets to a professional tool requires an initial effort. With a PMS system, it is necessary to train the portfolio managers, transfer the customer base and strategic investment specifications to the new system. Thus, the integration of a PMS always requires a transitional period and associated investments. The same applies to the introduction of a CRM or other tools.

In addition to the initial outlay, these systems are also associated with ongoing costs (pricing for most software vendors is tied to the amount of assets managed). Despite the trend, this continues to keep many EAMs from using these. In conclusion, there will still be EAMs in the future that operate without external PMS and CRM tools.

Diversified investment universe

The ongoing diversification of the investment universe ranks fourth in our survey, regarding importance from EAMs. More and more clients have specific investment needs, and the traditional 60/40 bond/stock portfolio is being replaced by individual portfolio strategies. The trend towards more alternative investments – especially private equity – was seen as relevant by the majority of banks surveyed. This is confirmed by a look at the BCG Global Asset Management 20212 Report. The report shows private equity as one of the largest growth markets in asset management for the next few years.

This will also leave its mark on the Swiss EAM industry. There are already some EAMs that have specialized in brokering private equity investments in certain subject areas, for example in Silicon Valley or in Zug’s Crypto Valley.

Digital assets such as cryptocurrencies, tokenization or non-fungible tokens (NFT) were consistently classified in the interviews as not relevant or not yet relevant. This explains why the trend as a whole tends to be in the midfield.

The long-predicted consolidation is accelerating

Studies have been predicting consolidation in the Swiss EAM market for many years. According to custodian banks, however, this trend has not yet materialized. One reason often cited for this is that there are no sellers. Custodian banks are repeatedly asked by EAMs about opportunities to buy up other EAMs. There are plenty of potential buyers, but hardly any EAM wants to sell.

However, due to the effects of the regulatory pressure described above, EAMs will have to cooperate with others more and more by the beginning of 2023. This assessment is shared by all respondents. Therefore, it is to be expected that the long-awaited trend of consolidation in the EAM market will accelerate.

Customer loyalty is and remains core competence of EAMs

Digital offerings such as robo-advisory are clearly not (yet) seen as competition to EAMs by the respondents. As a result, the trend in second-to-last place. However, industry experts noted that upcoming, younger generations of clients are responding to such topics. It is therefore conceivable that the pressure from alternative, more favorably priced offerings of wealth management services will intensify in the coming years. As of today, however, no relevance is attributed to this.

The least weighted trend overall is digital customer interaction. There are two reasons for this: First, virtual collaboration with video conferencing has already become established today and is therefore no longer seen as a trend. Second, for the respondents, personal interaction between EAMs and their customers will continue to be very important in the future. A personal, often friendly customer relationship is one of the most important value propositions of EAMs compared to private banks.

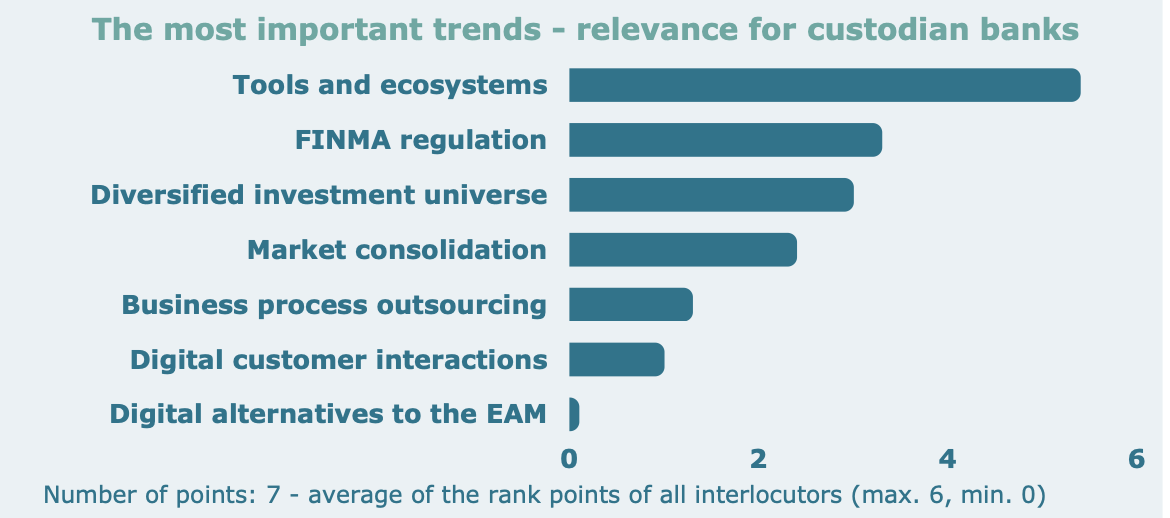

Opportunities and challenges for custodian banks

In the second part of the discussion, the same trends were examined from the perspective of “Relevance for custodian banks”. There are some differences to the view described above with “Relevance for EAMs”. For example, the trend towards easier access to digital ecosystems clearly ranks first, whilst outsourcing of EAM business processes has little relevance for custodian banks.

Increased efficiency for banks through use of tools and ecosystems in EAMs

In the order of trends relevant to banks, access to ecosystems comes out on top as the most important trend (see chart). Digitalization is therefore driving banks in the EAM sector more than regulation.

Two main reasons are responsible for the importance of tools and ecosystems: First, when EAMs use tools, management on the bank side becomes more efficient. The use of automated and standardized interfaces reduces the effort required to collaborate and process stock market orders and transaction/position data. Secondly, the integration of new customers becomes easier.

This is because the industry is increasingly using standardized, modern APIs instead of old, file-based proprietary interfaces.

When placing stock market orders with the bank, for example, a personal contact is still often sought from the EAM employee to the customer advisor. Ordering by e-mail with Excel file or even telephone may be convenient for the EAM customer for the bank, such orders generate very high manual efforts. As soon as the EAMs use professional PMSs, orders can be transmitted directly into the bank’s trading system. This means that orders are processed more quickly and less prone to errors due to fewer manual interventions, and communication is secure.

As already explained, not only large and medium-sized EAMs are using modern technology to handle internal processes, but also an increasing number of smaller businesses. However, an individual connection of smaller EAMs via proprietary interfaces is often not worthwhile for custodian banks and software providers. Standardized APIs, on the other hand, are much more efficient and faster to integrate. Today, the release of proprietary data via the interface can in part already be controlled by the user via e-banking, almost in real time.

According to many respondents, standardization of today’s heterogeneous interface landscape is highly desirable. Some participants are pinning their hopes on the OpenWealth API standard. This is being defined by an association whose members include Swiss Infrastructure and Exchange (SIX), many WealthTechs, and an increasing number of custodian banks. As of April 2022, six of the seven custodian banks we interviewed are members of the OpenWealth community. The future of this standardization project will depend on whether the large banks actively offer corresponding APIs soon.

In addition to traditional topics such as asset data and stock market orders, the exchange of client information and documents is becoming an important topic in the use of APIs. By enabling the electronic exchange of customer data and documents, the often complex KYC processes become more efficient for EAMs, custodian banks and, last but not least, end customers.

Benefits for banks through regulation of EAMs

In second place in the ranking with relevance for custodian banks are the increasing regulatory requirements for EAMs. The respondents see opportunities here in two areas:

On the one hand, customer loyalty can be strengthened if a bank supports the EAM in setting up the compliance processes by providing personal advice and assistance. Banks have much more experience in this area. On the other hand, some banks hope to be able to expand the relationship of trust through networking and support in mergers of smaller EAMs and thereby gain customer funds. Some respondents expect easier internal bank compliance requirements with regard to EAM clients, as EAMs now have to take on more extensive duties and are FINMA- supervised.

However, custodian banks need to clarify and communicate early on how they will deal with EAMs that let FINMA deadlines pass idly. Ultimately, unilateral termination of the business relationship may be required.

Diversification of the investment universe as an opportunity for the larger custodian banks

For the respondents, it is clear that the global development of asset management

has a direct impact on custodian banks in the Swiss EAM market. The trend is ranked third. Above all, the ubiquitous sustainable investments and private market investments were often mentioned by the respondents.

Custodian banks need to enable the handling of private equity investments for EAM clients. Building up internal competencies in this area can be worthwhile for custodian banks.

EAM consolidation as a growth opportunity

In the middle of the trends, from the custodian banks’ point of view, is market consolidation. While it is undisputed that consolidation is imminent, the impact on banks was assessed differently. Some of the respondents see opportunities to acquire new EAMs as customers during this turbulent time.

For example, there have already been some acquisitions of EAMs by private banks this year. Such a transaction can be mutually beneficial. The FINMA requirements are adopted by the banks, which are already much more heavily regulated and governed, and the bank gains “assets under management” and the EAM can continue to focus on its competencies. In return, however, the bank assumes responsibility and risks of the clients it takes over. A thorough examination of the customer assets before the takeover is therefore essential.

A merger of two or more EAMs brings growth opportunities for custodian banks. The new, larger player is an interesting new client, especially if the bank has already worked successfully with one of the merging EAMs.

Some trends hardly affect the custodian banks

The outsourcing of business processes by the EAMs was still second place and obviously has high importance for the EAMs.

However, development is not equally important for the banks’ collaboration with EAMs. This is because outsourcing is mainly used by EAMs for control and risk processes. Custodian banks have little involvement in these EAM processes.

The increased digital client interaction and digital alternatives to EAM (robo-advisory) are not important for custodian banks. Thus, these two topics are in the last two places. The reasons are more or less the same as from the EAMs’ point of view.

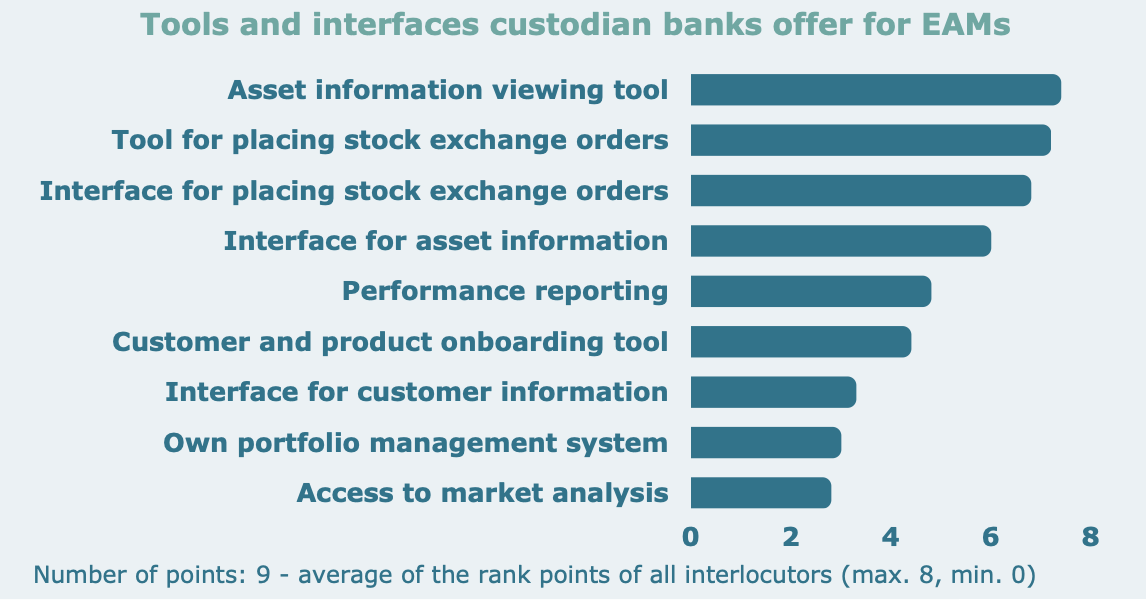

The most important offerings of EAM-specific tools and interfaces

In addition to the trends, we talked with our interviewees about the offerings of the custodian banks in the area of tools and interfaces. The question was which of the services of a custodian bank listed below are most important for EAM clients. The selected offerings, as well as the results, can be seen in the chart on page 12.

Unsurprisingly, the tools for asset view and order entry were rated most important. Both are unanimously regarded as basic services.

This is followed by the interfaces/APIs for these two topics. Order entry takes precedence over the exchange of assets. For the banks, an order interface is therefore even more important than an interface for asset data.

Performance reporting holds its own in the midfield, although a distinction must be made: Simple performance reporting is standard and must be offered.

However, sophisticated, individual reports are only offered by very few banks and therefore remain rather a niche offering.

The banks surveyed that already offer digital customer and product onboarding tools would welcome EAMs making more use of them in the future. However, the acceptance of such offerings is not yet as high as expected by the custodian banks.

Offering a PMS system for EAMs was not seen as necessary by any of the respondents. On one hand, EAMs often do not want custodian banks to see customer portfolios at other banks. On the other hand, banks see no strategic benefit in acting as a tool provider for a PMS solution.

The outlook for the coming months remains exciting

In the coming months, all market participants will be watching with interest to see how EAMs that do not yet have a license will be able to cope with FinSA regulation. However, it is clear to the representatives of the custodian banks that the EAM market will continue to develop technologically beyond FinSA implementation.

It will be interesting to see how quickly this development proceeds and how far- reaching the structural changes are. Thus, the EAM market remains one of the most exciting areas of the Swiss financial center.