How does Singapore’s status as a wealth management hub make it a target for financial crimes, and what strategies are needed for effective client management?

Singapore stands out as a significant hub for wealth management due to its political stability and strong economy, which provides a secure environment for investors looking to protect and grow their assets. The city-state’s favorable tax policies, including low taxes and various incentives, make it an attractive location for wealth management firms and family offices.

Additionally, Singapore boasts an advanced financial infrastructure, offering a wide range of banking and investment services that support efficient wealth management. However, this attractiveness also makes Singapore a target for money laundering activities.

The high volume of global transactions in its open economy creates opportunities for illicit financial activities. Money launderers are drawn to Singapore’s strong currency and economy, where their wealth can appreciate over time.

Recent high-profile cases, such as the two billion-dollar scandal involving Chinese nationals, have highlighted the city’s vulnerability to financial crimes. Despite stringent regulations, the complexity and sophistication of financial crimes pose ongoing challenges for regulators and law enforcement.

The Monetary Authority of Singapore (MAS) puts a lot of focus on the client onboarding process and continuous monitoring of clients (MAS Circulars on Money Laundering (ML) and Terrorism Financing (TF) and Establishing Source of Wealth (SOW) of Clients.

MAS has highlighted:

- Importance of Establishing SOW: Financial Institutions (FIs) must establish and corroborate the SOW of their clients to ensure the legitimacy of their assets and mitigate money laundering and terrorism financing risks.

- Risk-Proportionate Approach: FIs should adopt a reasonable and risk-proportionate approach, considering the unique circumstances of each client, and not apply a one-size-fits-all method.

- Senior Management Oversight: Senior management should closely oversee higher-risk accounts and ensure ongoing monitoring controls are aligned with a client’s risk profile.

As many banks focus on growth and are often targeted with hiring new relationship managers, efficient client lifecycle management (CLM) will be key to success. Client onboarding is the first high-touch client interaction and should be the start of a long-lasting client relationship.

Image 1: Client lifecycle phases

At finalix, based on our experience in CLM, we would advise banks to address the guidance from MAS by:

- Focusing on the Client Experience: Providing a seamless, user-friendly digital onboarding experience can help retain customers and build long-term relationships. Client feedback can be used to continuously enhance the process and strengthen the client relationship.

- Investing in Technology: A properly digitized client onboarding and maintenance process will help Senior management have a better oversight of client risks. For SOW corroboration, many documents are required, and proper document handling as well as making it accessible, will help in understanding client risks. New technologies like Generative AI can also be leveraged. Depending on the clients’ risks, additional approval processes may be required.

- Enhancing Data Management: Improving data quality, analysis (like pattern recognition and behavior analysis) and verification processes can help ensure compliance and enhance the overall client experience.

- Training and Development: Regularly training staff on new processes and technologies can help ensure they are equipped to handle the onboarding process efficiently (see finalix article).

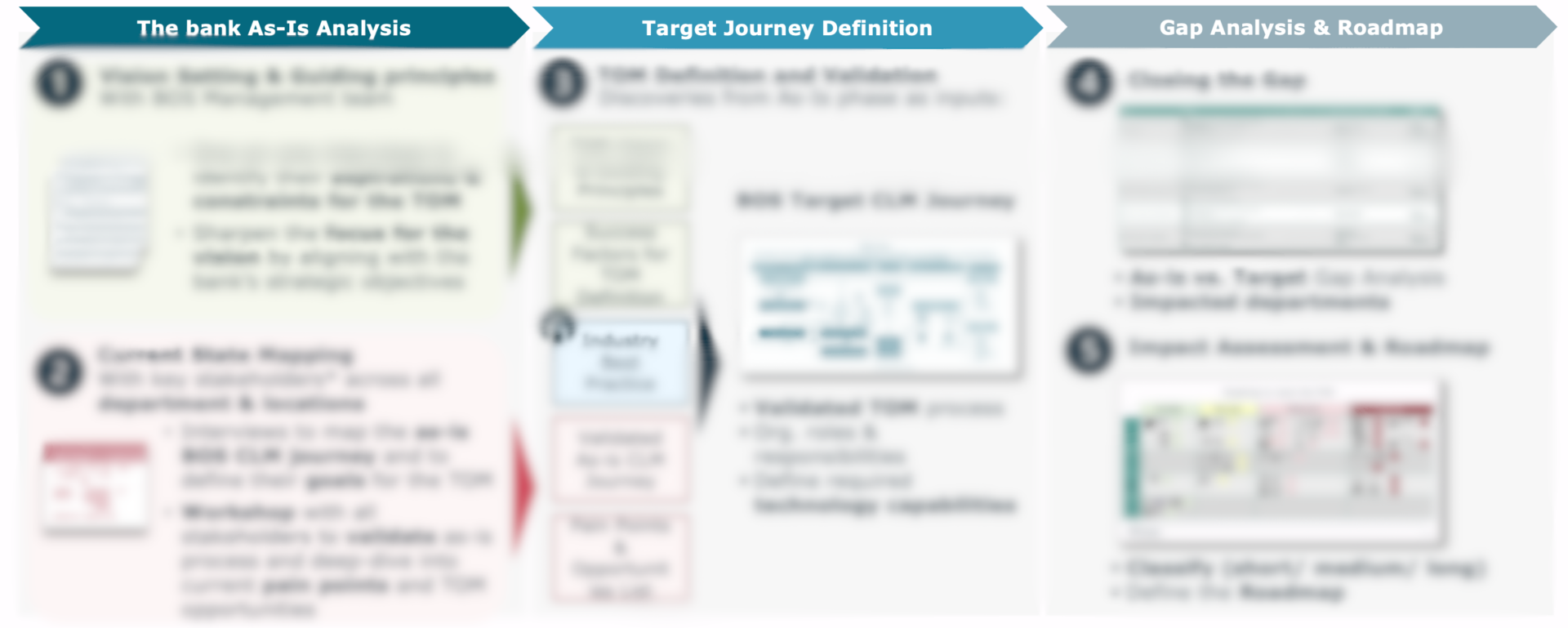

This does not mean banks need to reinvent their onboarding and maintenance processes. Finalix can help make an initial assessment of the current state to identify pain points and areas of improvement (point 1). A deeper analysis can be done by defining the bank’s vision and Target Operating Model (TOM):

1. As-is Analysis: Workshop/interviews with all stakeholders to validate As-Is processes and deep-dive into current pain points.

2. Define a TOM: With inputs from the bank’s vision, its pain points, and the expertise of finalix, we will work together with the bank to define a TOM. It is important to involve all departments to foster collaboration.

3. Gap Analysis and Roadmap: Define and prioritize the gaps and create a roadmap.

Are you struggling with efficiency and quality issues in your onboarding process? Are you stuck in an AML limbo? Contact our finalix experts to get back on track!