tIn our last article, we discussed the macro trends shaping the wealth management industry and how hyper-personalization with smart content management is an important competitive advantage to hone for.

- Hands off to Hands On – The move from passive to active investing

- No Such Thing as a Typical Client Profile – Client needs are unique and diverse

- Regulation – Stumbling blocks or stepping stones

To better tackle these challenges and develop a competitive advantage for wealth management firms, we recommended a hybrid human–machine investment advisory model. This model relies on enabling RMs through technology to better serve clients with personalized content and compelling stories.

The technology behind content management rests on four pillars of effective,

- Creation

- Matching

- Distribution, and

- Feedback loop

In this article, we will deep dive into the common challenges associated with content creation and matching, where we begin to answer the question, “How does a Smart Content Management solution look like?”

CREATION – WHERE KNOWLEDGE BECOMES THOUGHT LEADERSHIP

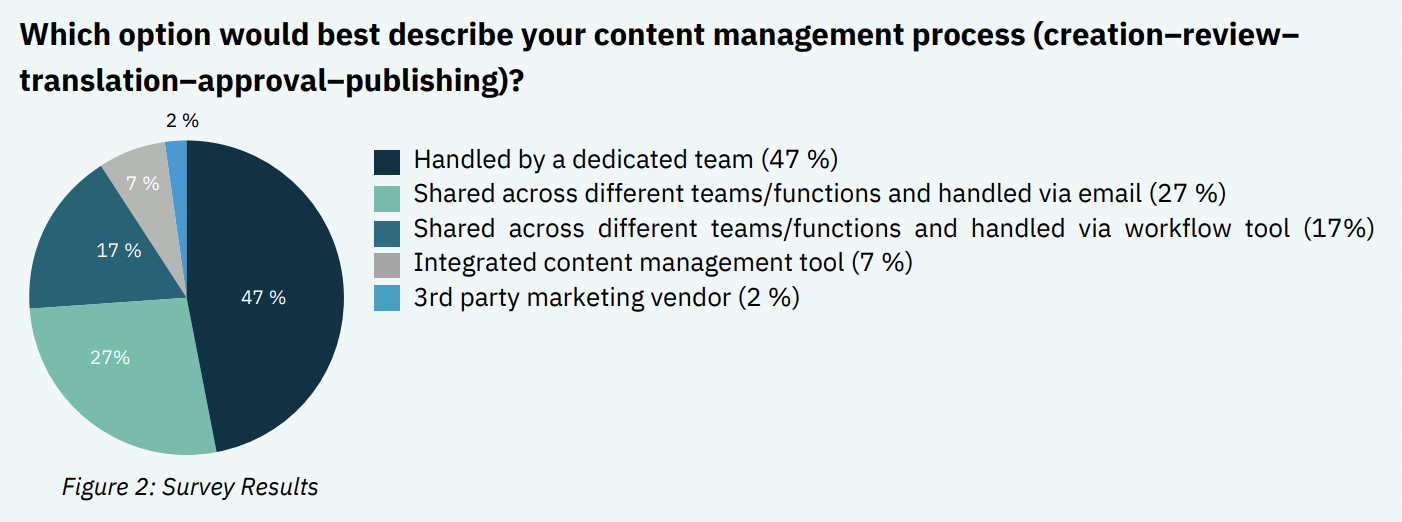

At many wealth management institutions, content creation is helmed by a dedicated team. The team researches and writes articles of interest across different themes, appended with

regulatory required disclosures. Often, the team engages multiple stakeholders and utilizes

different systems to escalate for review and approval before being deemed “Client Ready”. This is exacerbated when there are multiple content publications1 written in word-only format (Figure 1).

In order to create a reputation of thought leadership, timely publications of in-trend topics are

necessary. These publications can drive revenue-generating actions from clients, such as acting on buy/sell recommendations.

Therefore, a process that does not allow for agility and quick-to-client content could result in lost opportunities. Even so, many financial institutions are unable to attribute actions taken to the content distributed to their clients.

When considering the user experience across different channels, content needs to be simplified and adjusted for length to be made digestible and impactful. For example, content published on mobile applications should be bite-sized on mobile, as opposed to a full-length research pdf article shared via email. This increases the difficulty in creating content that remains engaging across channels.

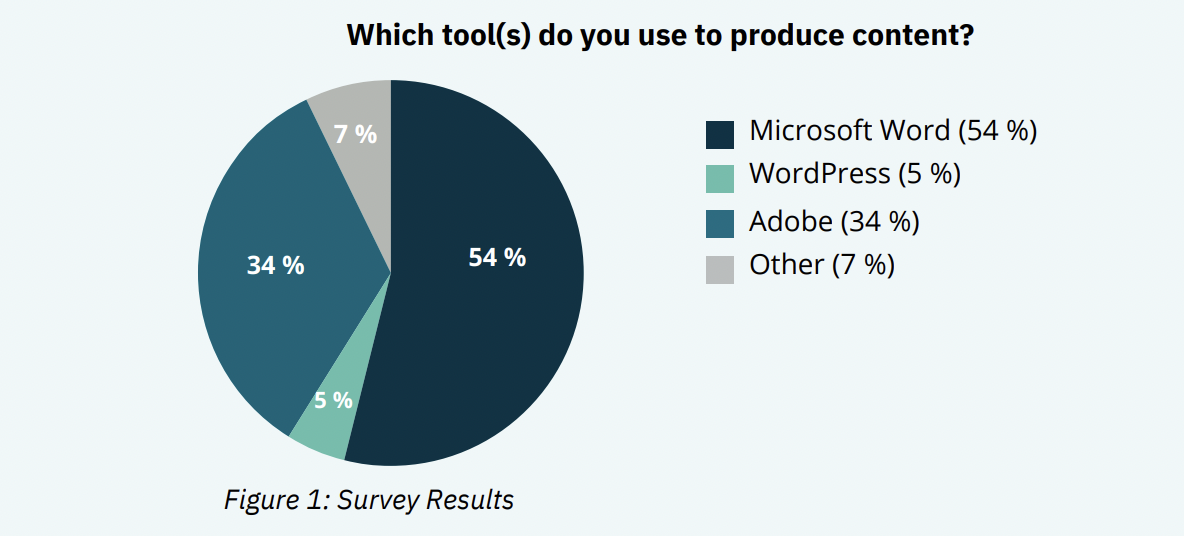

As illustrated in our survey response, 54% of content creators reportedly used Word Document to create content. This is however not suitable to be pushed to different channels, suggesting that additional work is needed to transform it into a compatible format.

Therefore, even with teams dedicated to specific content types (47%), the process is riddled with inefficiencies that prevent content delivery to clients from becoming a competitive advantage for the company. (Figure 2)

At a leading Swiss private banking group, product fact sheets were updated every month with market and forecast information. These fact sheets include charts and tables on performance, composition and etc. including disclaimers with legal information that are unique to each country. Altogether, the bank had 2000 fact sheets needing manual updates in multiple languages. Content creation and update is a laborious process meticulously tracked to ensure compliant, timely, and accurate information is provided to clients.

Solution

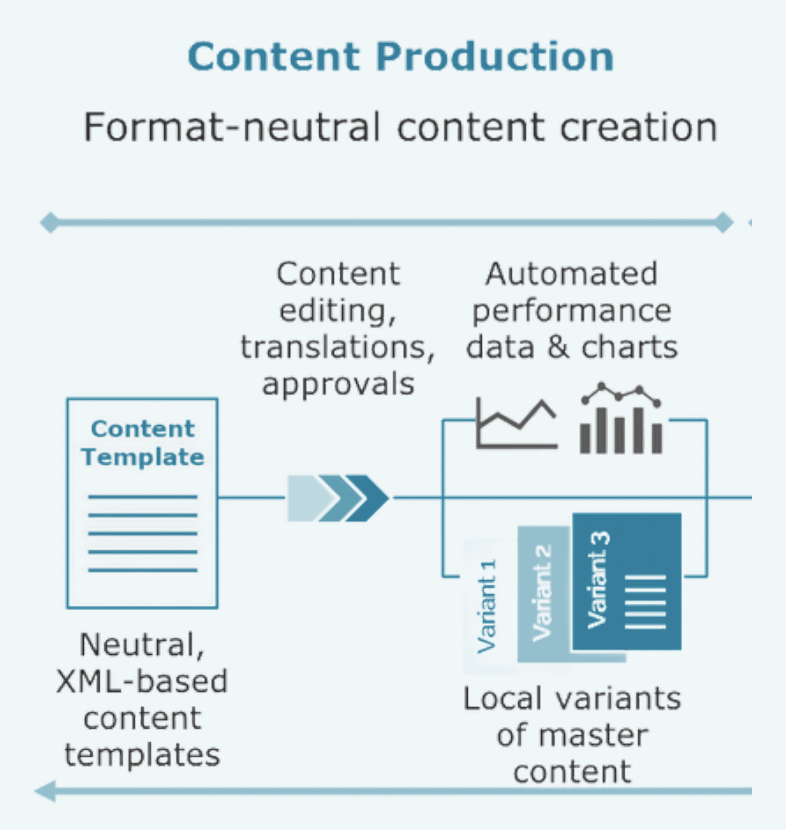

In order to overcome these pain points across different channels, financial institutions must first create a cohesive content strategy. Content strategies must consider the user’s journey of each content type in different channels. The created content has to be format-neutral and built out of data fragments to allow for maximum possible customization. This is made possible because fragmented content can be easily put together to adjust for the content length needed in different channels or client preferences. Mandatory disclaimers can also be easily included or excluded accordingly with consistency across channels.

Furthermore, the content is tagged with Meta Data 2 includes investment region, sector, product including information on the sector, product, date and time, and its uses. This allows the system to quickly recognize and tap on relevant content for better personalization. For example, content on technology-centric investment ideas can be matched to a client who has positions in the sector or has expressed interest in it.

Solid content creation practices serve as the foundation for a good content management

strategy.

MATCHING – BRINGING CONTENT TO THE RIGHT EYES

In many financial institutions, an abundance of static data is collected from their clients. These data points serve to paint an accurate picture of each client’s profile and their preference. That is, if this data is recorded, sorted, and stored in a meaningful way that can be easily utilized. This is not always the case. Very often, the first step of effectively being able to match content to the right clients starts with selecting personalization data and ensuring its usability. Good personalization data points should be relevant, up-to-date, and contextually complete3 For example, information on nationality would provide sufficient insight on perhaps the financial planning tools that are accessible for the individual. As opposed to age where it needs to be matched against other demographic data points to provide insight on the individual.

This brings us to the first question leaders should ask – “Are the existing processes and

applications using the right personalization points? Where do you get the data from and where do you store it?”

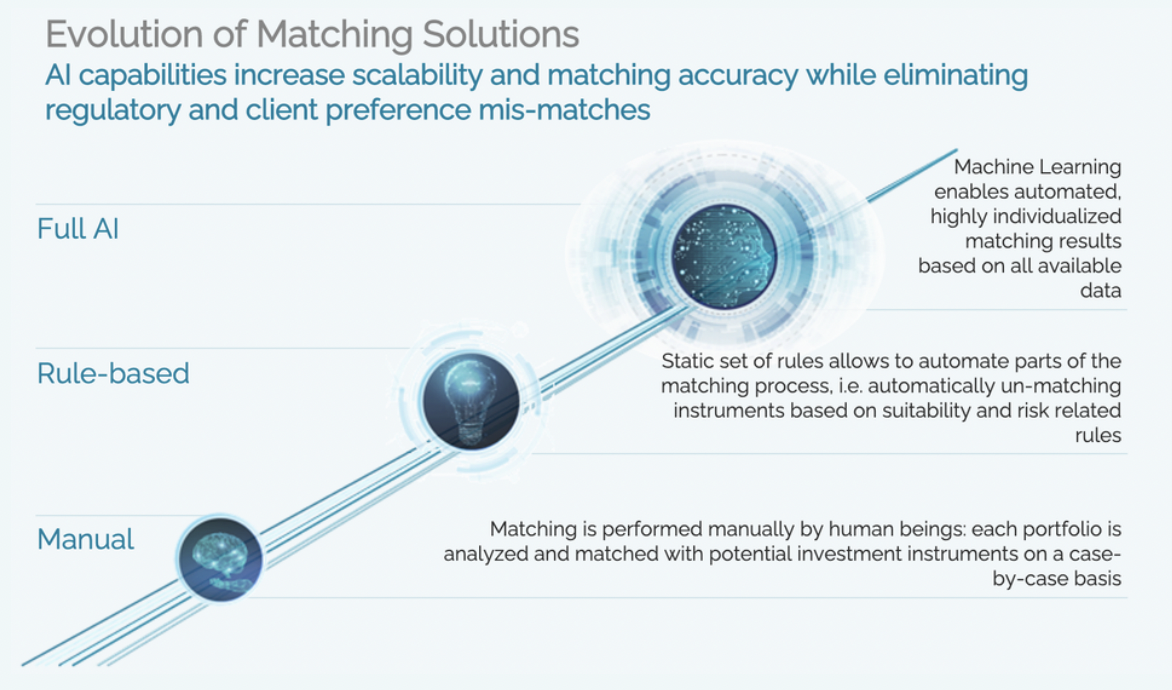

The most common matching approach is manual, through relationship managers (“RM”) with

knowledge of their client’s portfolios and interests, who would sieve out information of relevance to their clients. While this offers a personal and human approach towards curated content, it places a heavy responsibility on the RM. This process is tedious and possibly biased towards a few clients. Existing and profitable clients are naturally prioritized, leaving underserved clients a continued lost opportunity. Another approach undertaken by RMs is to send selected articles to all clients in an attempt to learn a new engagement point with his/her clients. Neither methods are optimal.

In Static Rule Based matching, the benefits include an easy-to-implement solution that can

quickly reap business value. Most often, the rules consider suitability and cross-border regulatory concerns, and this helps ensure that content matches are regulatory compliant. However, with standards increasing in a digitalized landscape and more unique client profiles, Static Rule Based solutions do not keep up to date or take into consideration client interests and behaviour.

This could result in irrelevant content pushed to clients, leading to client frustration, content

fatigue and disengagement. Outcomes that are diametrically opposed to the goals of smart

content management. Nonetheless, this approach still represents a good stepping stone towards more sophisticated solutions.

Therefore while Manual and Static Rule Based solutions are necessary steps of the evolutionary process, companies looking to make content management a competitive advantage should look towards developing Machine Learning capabilities.

Solution

In a Machine Learning (“ML”) matching solution, content is first matched to clients via defined rule-based selections. This is where the similarities with a static rule-based solution ends. The key difference here is that the ML solution can “Learn” in accordance with feedback received from clients. Through collected feedback, the model starts to evolve and build a profile of the client’s preferences for content. It notes greater engagement, i.e which articles were read, and which articles were ignored. Learning what content to continue distributing and what to discontinue. If the client’s preferences change, the model recognizes the latest behaviour patterns and adapts accordingly.

Patience is critical to the success of an ML model. In the beginning, an ML model requires some static rules to be configured. Once enough data is collected, an ML model has the potential to suggest new content to clients of similar profiles, evaluate the client reception to this content and continuously enhance its personalization offering. Something that a Static Rule Based solution will not be able to achieve.

This does not mean that RMs will take a back seat or become irrelevant. Content Management systems can also provide RMs with a list of recommended content matched to clients. This enables RMs, to be well-equipped to share content or start conversations and test the interest of their clients. At the same time, underserved clients could receive targeted content, spurring them to reach out to RMs. This is the first step towards an expanded loyal client base.

CONCLUSION

Ultimately, great content management strategies create stories out of information. These stories captivate their readers and spur them to take well-informed actions. Stories also provide RMs with opportunities to start meaningful conversations with their clients. This is achieved by best-in-class Content Creation and Matching solutions that serve as the bedrock for the next steps – a strong Distribution and Feedback Loop. That said, one should not understand “Best in Class” to be equivalent to implementing complicated solutions all at once. By identifying the relevant content type and the matching method to start with, a strong foundation is established on which incremental changes can be built on. This way, simplicity, and patience pave the way for significant business values to be enjoyed by all stakeholders along this journey.

In our next article, we explore the challenges and possible solutions in Content Distribution

and user Feedback Loop. The third and final step in creating compelling stories.

About finalix

Finalix is a consulting boutique with a focus on the financial industry. Originating from Switzerland, the company was founded in 2001 and opened an office in Singapore in 2019.

Finalix supports a wide range of financial services providers from banking – universal banks, private banks, asset managers, and private equity corporations – to insurance. The company focuses on digitization and transformation projects covering key senior roles on the business side as product owners, SMEs, and stream leads. Finalix consultants have on average more than 12 years of significant work experience with renowned consulting companies and senior roles in the financial services industry. They bring strong skill sets, fast adaptability to new environments, and instant value delivery to their projects.