Technology has created the potential for wealth management firms to leverage their troves of client data to curate a unique customer service journey tailored to individual client needs.

Historically, the firms which have managed to attract and retain customers offer diverse products and are able to adapt to their client’s changing needs with time. Dedicated relationship managers (RM) create long-lasting profitable relationships for firms. However, the pandemic challenged the sustainability of such a model. If firms want to provide personalized investment information at scale, they need to rely on smart content management solutions.

This paper explores 3 key trends, their challenges to the wealth management industry and

concrete steps to adopt a hybrid human–machine investment advisory model.

• Hands off to Hands On – The move from passive to active investing

• No Such Thing as a Typical Client Profile – Client needs are unique and diverse

• Regulation – Stumbling blocks or stepping stones

Content is based on a survey with Financial Institutions headquartered in different regions,

conducted in collaboration with Hubbis.

MOVING TOWARDS A HYBRID HUMAN–MACHINE INVESTMENT ADVISORY MODEL

Prior to the COVID-19 pandemic, digital transformation in the wealth management industry was

already a strategic imperative well underway. With increased vaccination rates globally, a new normal has emerged with digitalization at the forefront of adaptation strategies. At stake are customer loyalty, engagement, and experience. A winning hand for customers’ hearts and mind have meaningful insights, hyper-personalization, and customer service. Not forgetting that customers themselves have raising expectations as they too enjoy the increased digital interactions in all aspects of their life.

Underpinning this move towards digitalization is Technology. It has created the potential for wealth management firms to leverage their troves of client data to curate a unique customer service journey tailored to individual client needs. Historically, dedicated relationship managers (RM) curate investment information and delight their customers, creating long-lasting profitable relationships for firms. However, the pandemic challenged the sustainability of such a model. If firms want to provide personalized investment information at scale, they need to rely on smart content management solutions.

In a recent survey by Factset, the top 3 factors that provide clients assurance of the credibility of their Wealth Manager are an excellent brand, competent employees, and quality information for investment ideas. With a focus on digitalization and technology, firms can consider the following actions when establishing an intelligent content management solution to ensure personalized content.

- Production – Leverage technology to automate the production of format-neutral content

- Matching – Match content with client recipients based on the analysis of existing client data,

- preferences, and regulatory requirements

- Distribution – Reduce the cost to serve by enabling automated distribution of content through various channels (Social media, E-banking, Mobile App, Email, and Print)

- Intelligent Learning – Enable the content management solution to learn through an automated feedback loop

This does not mean abandoning the RMs that are crucial to the business model. Instead, a hybrid

model is suggested, in which RMs are enabled by technology in order to serve more clients more

meaningfully.

MACRO TRENDS & THEIR CHALLENGES

Hands Off to Hands On

High Net Worth Individuals (“HNWI”) are starting to move away from passive investment strategies to making self-directed investment decisions. This leads to a demand for greater access to timely information on investment products or topics of interest relevant to their portfolio needs. In an environment where it remains common for RMs to manually customize reports provided to clients, these demands are oftentimes left unmet, resulting in unquantifiable lost opportunities and frustrated clients.

Investment options and demands are more varied than they have been in the past. Whether it is in

Environmental, Social, and Governance (“ESG”) related space or alternative investments like digital currencies or Non-Fungible Tokens (“NFTs”). It becomes more costly and effortful for firms and their RMs to provide adequate information and complete information to clients for their decision-making.

No Such Thing as a Typical Client Profile

The profile of the client is becoming increasingly diverse. There are 114% more female-owned

businesses in the US than there were 20 years ago. The wealth in emerging markets continues to rise, triggering a class of “nouveau riche”. Technology and alternative financial products have

created new sources of income, many of whom are young and tech-savvy. The family nucleus is

also evolving. With more single-parent families, cohabitation, and same-sex marriages in recent

decades. Against this backdrop, wealth management firms are pressured to keep up, empathize

and deliver accordingly.

Firms should reflect whether:

- They understand the unique and nuanced needs of their clients against so many personalization points

- They leverage existing client data to discover meaningful insights

- The status quo of a bank-centric approach is ready for an increasingly customer-led industry

MACRO TRENDS & THEIR CHALLENGES

Regulation – Stumbling Blocks or Stepping Stones?

Some regulators, now conscious about not becoming obstacles to innovation, are working with financial institutions to better understand ways to shape the business landscape. Nonetheless, in a global market, keeping up with different regulations and their changes can be difficult. In Thomson Reuters’ 2018 Cost of Compliance report, there were more than 56,000 regulatory changes in 2017 alone.

It appears meeting these obligations necessitates higher expenditures or risks stiff penalties. At present, accountability is pushed to the Front Office, who is expected to also be self-enforcing compliance requirements. The sheer difficulty of this deters firms from capitalizing on new business opportunities, whether in new spaces or geographical locations.

It is precisely because of the difficulties that firms who have a handle on this find themselves with a lasting competitive advantage. Many compliance officers see technology as part of the answer. By ensuring that operations adhere to a robust framework that includes checks on licensing regimes and client suitability, firms can efficiently offer client-compliant information and offerings. This contributes to better client engagement, and ultimately more business for the firm.

How does a global wealth management company sharpen its competitive edge?

A large Swiss Private Bank used to depend on their RMs having access to all sales-related materials, everywhere. From pitch books, presentations to fact sheets. Ensuring materials were up-to-date, compliant and timely distributed to clients was an onerous task. In 2018, the Bank adopted a technology-enhanced content management approach to automate this process, free up time of their RMs to be better spent engaging more clients on a meaningful level. Through an integrated content management solution, its content templates are automatically updated, translated, compliant with regulations and distributed. This improved efficiency and reduced the time spent by RMs on administrative tasks and automated regulatory requirement fulfillment that used to be a tedious process.

Amidst this challenging landscape lies opportunities to create a competitive advantage for firms

that can adopt a hybrid model where RMs are enabled by technology-led content management

solutions.

BANKS RECOGNIZE THE NEED FOR A HYBRID SERVICE MODEL, FEW HAVE TAKEN THE LEAP

Firms that adopt a hybrid human–machine investment advisory model will find themselves with a success differentiator. The APAC region sees more RM-client interaction as clients are often served on an advisory basis and tend to transact more frequently. Digital disruption is also happening apace in this region, clients tend to be more digitally savvy than in Europe, allowing digital service models to be more commonly adopted. This might be the reason for (1) a fully customizable, comprehensive, client-driven multi-channel interaction, and (2) advisor enablement being listed in Accenture-Orbium survey as one of Wealth Management’s (“WM”) top priorities for 2025.

Despite this, only a handful of market leaders have taken the leap towards a technology-enabled solution. Why is that? Reasons are multiple and varied, but a simple element can explain this discrepancy: the fear of sailing in the unknown.

In wanting to design a future-proof customer experience that revolves around hyper-personalization, most WM are still uncertain of the right business model to implement and the necessary technology to drive it. As a result, many WM are tempted to adopt a passive approach by waiting for the market leaders to implement their own strategies and follow suit after.

Nonetheless, with the acceleration towards digitization and hyper-personalization of client engagement, such a wait-and-see approach is a dangerous game where losing the competition may have a lasting impact on the firm’s ability to attract and retain clients.

A LEAP IS NOT NEEDED – START WITH TAKING THE FIRST STEP

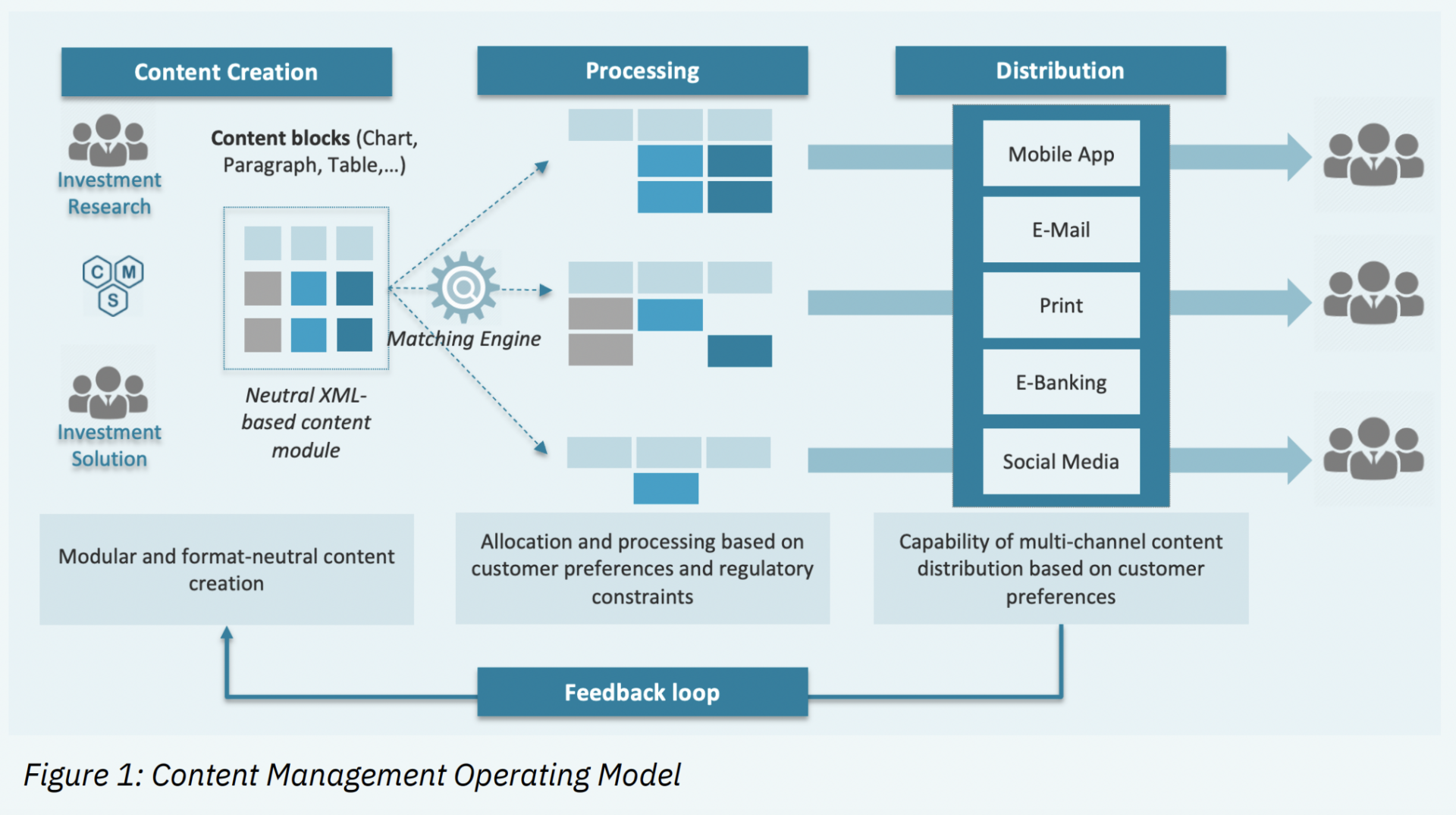

By first understanding the gaps between the current content management model and its ideal state, firms can establish an implementation roadmap. Figure 1 represents the 4 key pillars of a Content Management solution. These pillars are content production, matching, distribution, and feedback. By using this as a guide, firms can establish their own vision of an ideal state. Following this, firms can identify room for improvement in their own content creation, approval workflows, governance, and personalized content distribution process.

BUILDING BLOCKS FOR A FUTURE-PROOF INTELLIGENT CONTENT

MANAGEMENT SOLUTION

Sounds simple and ready to ramp up implementation? Our experience has shown that firms who are overly ambitious and eager to overhaul all existing processes and tackle every aspect of the value chain at once, often find themselves with an incoherent operating model that not only fails to deliver the vision but puts them at a disadvantage.

Being able to leverage existing data to develop insights through artificial intelligence (“AI”) remains a crucial element in achieving hyper-personalization as a competitive advantage. It’s a given. But firms should not put the cart before the horse. Such insights would fail to translate into more client engagement if WM do not have their content format-neutral and ready to be sent to their clients through their preferred channels. Understanding this multi-layered complexity, we support a modular approach where focus is first placed on content creation. Our expertise has shown that this creates the solid foundations upon which a future-proof content management solution can be built. Only then, organisations should seek to implement robust data management that cut across data silos throughout the enterprise to be able to leverage their data.

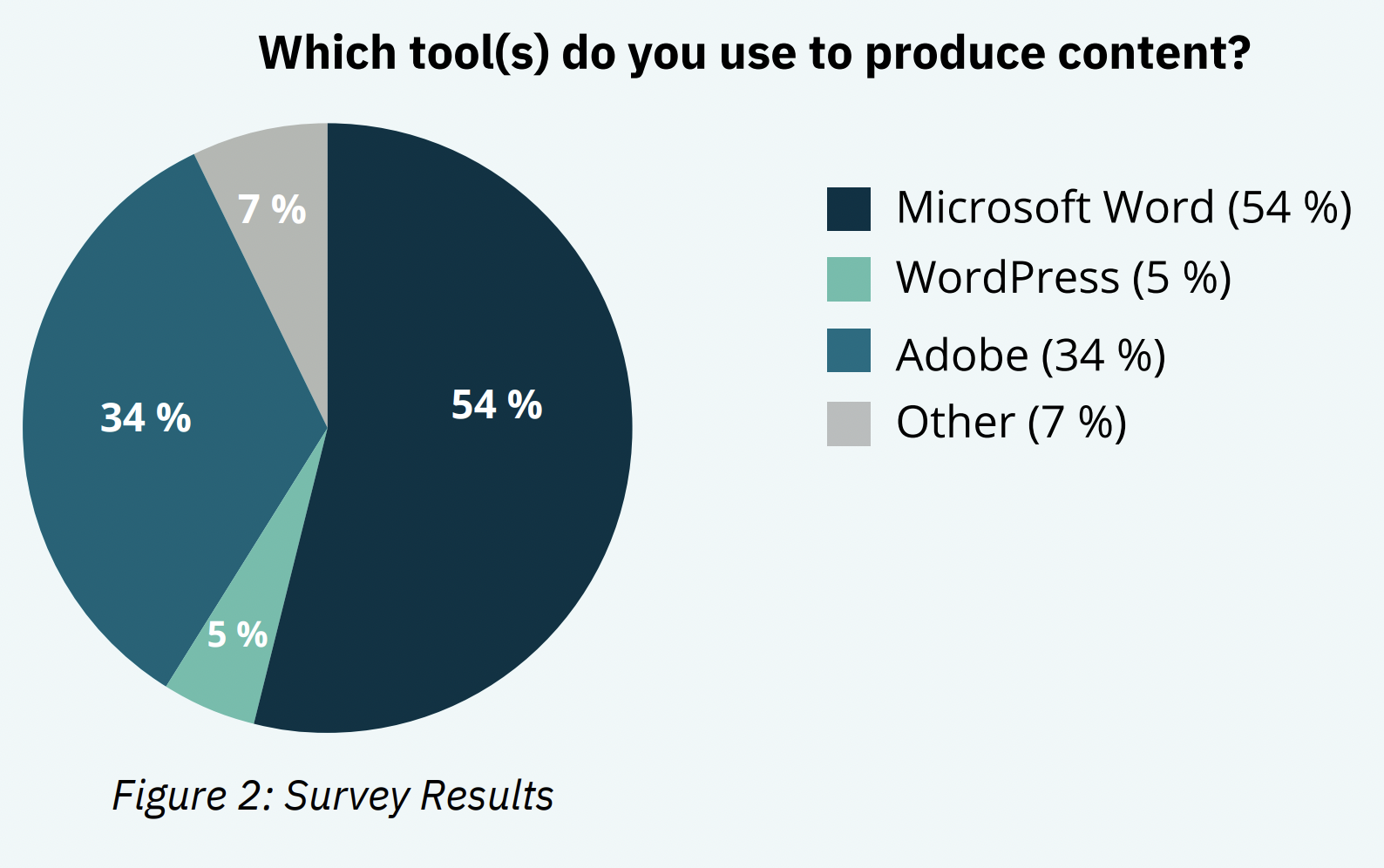

Our survey shows that many firms depend on static and format-dependent tools to create content. This limits their ability to keep information up-to-date and consistent. It is also labour-intensive and prone to human errors that could result in regulatory breaches.

REAP THE REWARDS EARLY

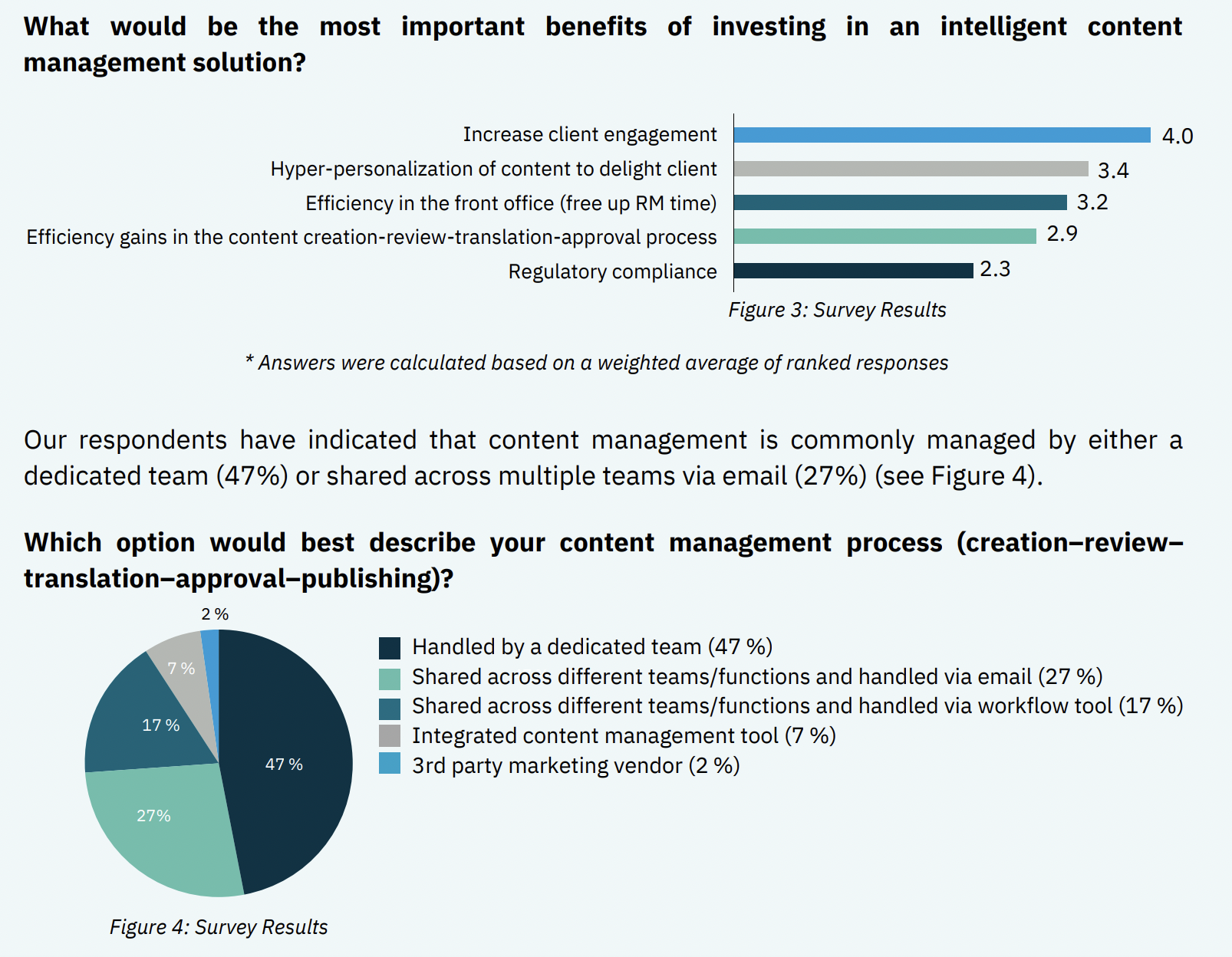

When asked about the importance of potential benefits reaped from an intelligent content management solution, many respondents ranked “Increase Client Engagement” to be the chief benefit while “Regulatory Compliance” takes a back seat (Figure 3). While firms are eager to see their return on investment coming from higher client engagement and satisfaction, they should not underestimate the potential cost savings of more efficient regulatory risk management. This can come from requiring fewer manual processes to ensure compliant content, e.g. disclaimers.

NEW MODEL – FORMAT-NEUTRAL CONTENT CREATION/DISTRIBUTION

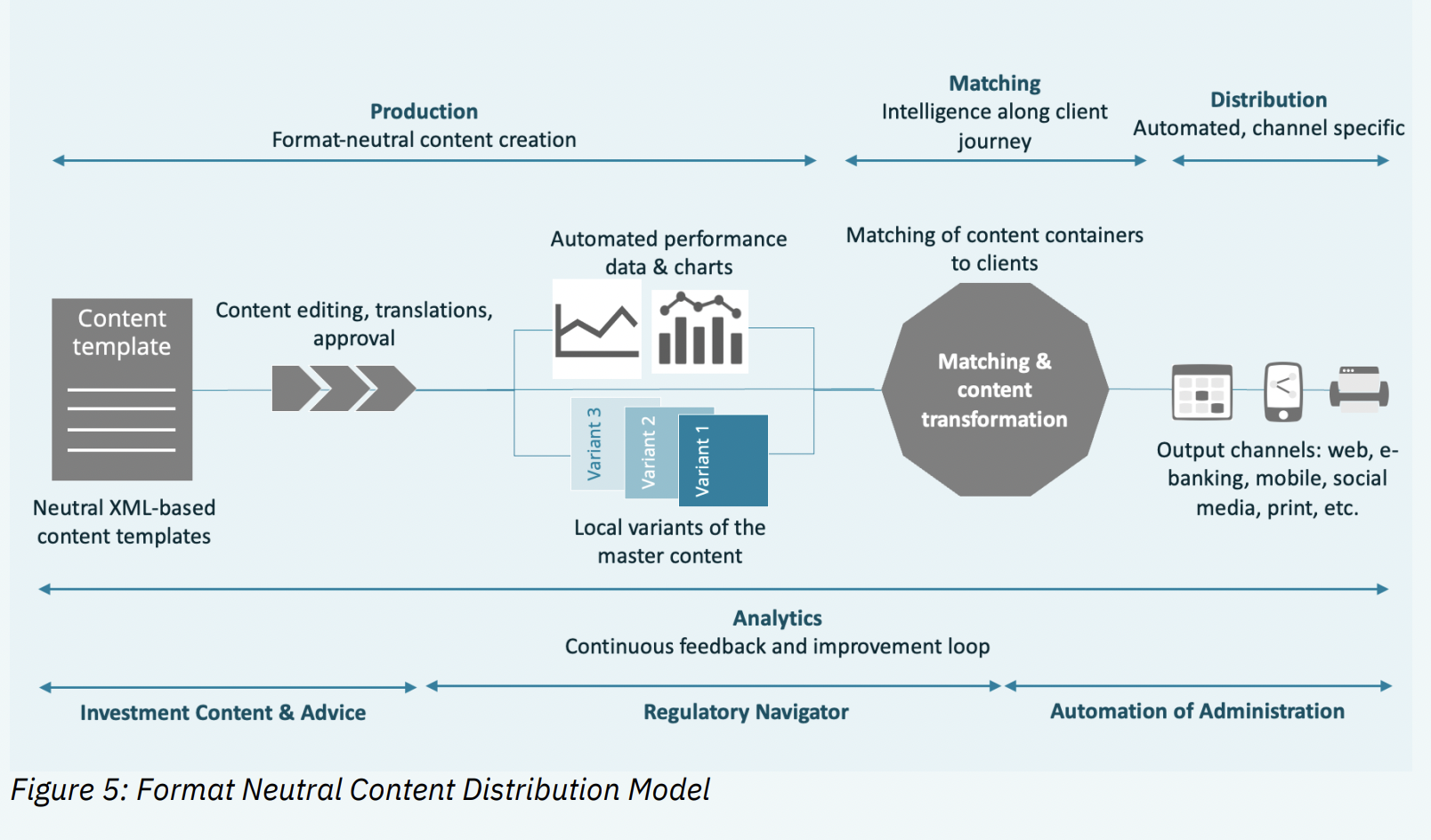

Content creation involves many tasks that are executed by various teams like content writing & editing, translation, approvals, and others. This labour-intensive process can be made more efficient while reducing risks when implementing a state-of-the-art content management tool. Referencing Figure 5, one can see how adopting format-neutral content creation in a defined workflow can provide tangible efficiency gains for the content management process. The content can then be distributed via the hybrid model to serve more clients more meaningfully.

REMOVING ROADBLOCKS AND PAVING THE WAY FOR CHANGE/SUCCESS

Not having a strong culture for change is one of the biggest challenges. From our experience, RMs want to control the content sent to their clients and liaise with them personally. In its ideal state, the content management model does not replace the role of RMs, but rather, it enables the RMs to focus on cultivating strong personal client relationships by providing RMs easy access to ready content. When improving the Content Production process, all stakeholders (marketing, translators, approvers, investment writers, and RMs) should be involved at the earliest stage. Efficiency gains will be shared and experienced first-hand, increasing buy-in and adoption. Subsequently, when rolling out Content Processing and Distribution processes that allow automated matching to customer preferences and evolving behaviours, even more scalable efficiency gains will be generated to the front office.

FINISHING TOUCHES

After a company has decided to take the next step in Content Management, it is crucial to make

sure the following conditions are met:

• Clear definition of processes and assignment of responsibilities for such an initiative

• Structured overview of content types and potential content templates

• Readiness across teams to standardize certain processes (if needed)

• Understanding of the output formats and channels required today and the future

• Definition of typical client use cases, i.e., how do our clients engage with the content

Without these conditions, Companies risk developing solutions to address past and present client needs instead of anticipating future demands.

WHEN THEORY BECOMES PRACTICE

We recommend that a Proof-of-Concept (POC) be first established for a selected content type, format, and distribution channel. This serves as a basis to sequentially broaden the use cases to fully realize the benefits of an intelligent content management solution. Involving existing content management team members remain crucial towards starting champions for change from within the firm.

FINDING YOUR COMPASS WITH THE RIGHT PARTNERS

At Finalix, we bring our expertise in Intelligent Content Management in Wealth Management to our clients. Specializing in the rollout of successful projects in the APAC region to empower the next generation of advisors through digitally enabled workplaces and data-powered hyper-personalization to deliver best-in-class service.

On projects, Finalix focuses on consulting and conceptual work on the business side, breaking down the visions of the clients into implementable pieces, orchestrating the rollout, and liaising with the relevant product company and implementation partner.

About finalix

Finalix is a consulting boutique with a focus on the financial industry. Originating from Switzerland, the company was founded in 2001 and opened an office in Singapore in 2019.

Finalix supports a wide range of financial services providers from banking – universal banks, private banks, asset managers, and private equity corporations – to insurance. The company focuses on digitization and transformation projects covering key senior roles on the business side as product owners, SMEs, and stream leads. Finalix consultants have on average more than 12 years of significant work experience with renowned consulting companies and senior roles in the financial services industry. They bring strong skill sets, fast adaptability to new environments, and instant value delivery to their projects.

![Nikos Chan Main[1] Nikos Chan Main[1]](https://finalix.com/wp-content/uploads/elementor/thumbs/Nikos_Chan_main1-e1710846415983-qlfsll66o84x19jae2ipb1hr03zohmq3tcf4diho6a.jpeg)