The first finalix Sustainable Finance Roundtable took place on June 15, 2022. Together with representatives from the financial services and banking sectors, we confirmed that there is still a lot of room for interpretation of the individual regulatory packages of the “EU Action Plan”.

Using the SFDR as an example, we have seen that the impact of the individual product categories, i.e. Art. 6, 8 & 9, on financial participants is perceived differently. Financial instruments that comply with Art. 6 and do not have a focus on sustainability, but must take sustainability risks into account or make them transparent, are classified by some participants as no longer relevant in the future. On the other side, however, a raison d’être from the customer’s point of view is argued, since the customer wants to consider corresponding risks for his investments (e.g. emerging markets). For Art. 8 & 9 products (also “green” or “dark green” financial instruments) this question does not arise, as such products represent the core of an investment defined as sustainable under SFDR.

Furthermore, SFDR addresses the issue of greenwashing. The regulation narrows down the term through its definitions of sustainable financial instruments. It requires strict minimum disclosure standards at product and company level. This narrowing and clarification is seen by participants as a positive development.

In general, there is agreement that the individual regulatory packages sometimes contradict each other. For example, a financial instrument classified as sustainable under the SFDR and the EU taxonomy may differ. However, the EU Action Plan provides a basis for standards of sustainable investing in the financial industry and thus represents the beginning of a whole series of further regulations worldwide (including CH, Singapore, UK).

There is also the question of how the regulatory packages will be enforced and whether there will be any sanctions or penalties at all.

The participants see a clear and explainable classification of the financial instruments and the way of a meaningful profiling of the customer, which can also be conveyed by the bank advisor, as one of the central challenges in the implementation.

“Sustainable Investing” traditionally follows three customer motivations in terms of investment preferences:

- Investors who want to realize their personal values through investments,

- Investors who want to achieve a sustainable impact through their investments OR

- Investors who are indifferent to sustainable factors, but who do not fundamentally exclude them, as long as the maximum “performance” of the investments is guaranteed.

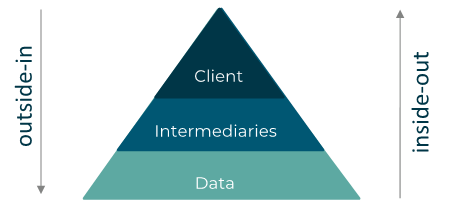

In the context of the updated MiFID II, this generates an area of tension in the mandatory profiling of clients with regard to sustainability preferences. The categories of the SFDR, the taxonomy and also the PAIs (Principle Adverse Impacts) must be explained to the client in an understandable way and in simple language. A simultaneous query of the traditional customer motivations for Sustainable Investing can easily overwhelm the customer (and the bank advisor) and therefore turns out to be challenging. A solution could be storytelling, which aims at communicating complex issues in a way that is easy to understand and thus achieves a satisfying understanding of the customer. One participant emphasizes that storytelling should take an outside-in approach (what does the customer want). This is countered that this is difficult to achieve under the regulatory framework. This describes the tension between outside-in and inside-out view in storytelling. Referring to a publication by Morningstar, it is also emphasized that the young generation primarily demand transparency and extensive options in terms of sustainable investments. This supports the argumentation towards an “inside-out” orientation of the bank.

Outside-in (what the customer wants) vs. inside-out (provide data from aggregated confusion)

The “inside-out” view can also be used to classify the current data situation in the context of the “EU Action Plan”. At the moment, there is no clarity in this context. The EET (European ESG Template) of Findatex, with 600 data fields, is very complex and currently only intended for the asset classes structured products and funds. For other asset classes, the data must be obtained from other sources. Since among the participants were manufacturers but also distributors of financial instruments, the importance of the EET from a distribution point of view was reiterated. There is an expectation that this will be completed and made available by the manufacturers. It is seen as a challenge here that financial instruments manufactured outside the EU (e.g. USA or Asia) will not have a standardized categorization on sustainability criteria according to the “EU Action Plan”. This is due to the fact that companies and manufacturers located there will not provide the data. Also, a shift to this categorization will have an impact on customer portfolios. For example, many currently sustainable instruments based on a bank’s own ESG logic will no longer be so after the EU taxonomy is applied. This will be directly reflected in the “Suitability Report” of the customers.

In summary, it was found that, above all, anchoring sustainable finance and ESG criteria in the corporate strategy is a central prerequisite for the company-wide implementation of sustainability, but that this can be observed extremely rarely to date. Anchoring sustainable finance in the corporate strategy would bring the question of “why” (why is sustainable finance important for our company and our customers, and what are the resulting goals?) to the fore, whereas currently the question of “how” (how do we implement the regulatory requirements?) is often the only focus, and a strategic reflection on sustainable finance is missing – a wasted opportunity for the financial sector. On the topic of aggregated confusion, the EU Action Plan is an important foundation on which a common language or industry standard will emerge over time, ensuring that banks and customers will have a common understanding of Sustainable Finance in the near future. This will help banks in their implementation activities as well as in their conversations with their customers, who should always be at the center of Sustainable Finance.

Below you’ll find the references used for this summary: